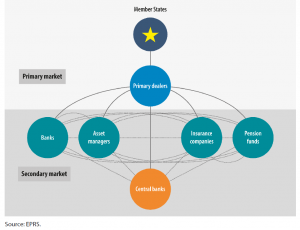

Sovereign debt instruments are issued by governments (directly or through specific agencies) on the primary market, where in most cases they are purchased by primary dealers, i.e. banks or other financial institutions which are authorised to trade securities with a government subject to certain legal and operational requirements. Primary dealers then negotiate these instruments with each other or sell them to other institutional investors (including banks, insurance companies, pension funds, savings managers, etc.), thus creating the secondary market in which the ECB and the NCBs of the Eurosystem conduct purchases in implementation of the various asset purchase programmes.

Payments deriving from the negotiations carried out on both the primary and secondary markets are settled in TARGET2. TARGET2 is the real-time gross settlement (RTGS) system for euro payments between banks in the euro area, owned and operated by the Eurosystem. Payment orders submitted to TARGET2 are processed and settled in ‘central bank money’, i.e. money that commercial banks hold in an account with a participating NCB and that participating NCBs handle in their own accounts with the ECB. When the banking system in one participating Member State registers more payment outflows than inflows, its NCB accumulates a TARGET2 liability to the ECB. In contrast, if the banking system faces more inflows than outflows, the respective NCB acquires a TARGET2 claim towards the ECB. TARGET2 balances therefore mirror the cumulative net payment flows within the euro area.

Be the first to write a comment.