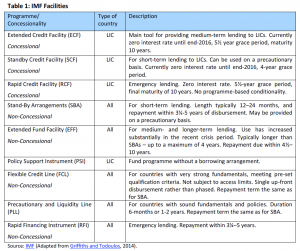

Non-concessional lending is provided mainly through the four facilities mentioned below. As with concessional lending, certain conditions must normally be fulfilled for assistance pay-outs to be made. The Stand-By Arrangements (SBA) has historically been the most important instrument for non-concessional lending to countries facing external financing needs. The country concerned must agree to address its balance of payments problems through achieving targets described in a letter of intent and in an MEFP. The Flexible Credit Line (FCL) is provided by the IMF for countries that find themselves in a cash crunch but have very strong fundamentals, policies, and track records of policy implementation. FCL is not conditional on specific policies being implemented. So far, Colombia, Mexico, and Poland have used the facility. The Precautionary and Liquidity Line (PLL) provides financing to meet actual or potential balance of payments needs of countries with sound policies, and is intended to serve as insurance or help resolve crises under wide-ranging situations. The Extended Fund Facility (EFF) can be used by the IMF to assist a country facing serious balance of payments problems in the medium term, where time is required to address the structural weaknesses.

IMF Facilities

Categories:

Related Articles

Visit the European Parliament page on

Visit the European Parliament page on

We write about

RSS Link to Scientific Foresight (STOA)

RSS Link to Members’ Research Service

Blogroll

Disclaimer and Copyright statement

The content of all documents (and articles) contained in this blog is the sole responsibility of the author and any opinions expressed therein do not necessarily represent the official position of the European Parliament. It is addressed to the Members and staff of the EP for their parliamentary work. Reproduction and translation for non-commercial purposes are authorised, provided the source is acknowledged and the European Parliament is given prior notice and sent a copy.

For a comprehensive description of our cookie and data protection policies, please visit Terms and Conditions page.

Copyright © European Union, 2014-2019. All rights reserved.

Be the first to write a comment.