On 17 September 1999, the Council adopted negotiating directives for the European Commission for the conclusion of an interregional association agreement between the EU and Mercosur. The AA was intended to be based on respect for democratic principles and fundamental human rights and to consist of three pillars: a partnership in political and security matters, economic and institutional co-operation and the gradual creation of a free trade area for goods and services that takes account of the sensitive nature of some products. The directives also sought to open the parties’ public procurement markets, liberalise the movement of capital and payments and adopt disciplines in areas such as competition and intellectual property rights.

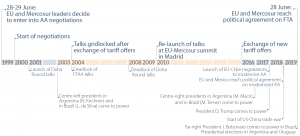

Formal negotiations began in April 2000 against the backdrop of high EU expectations for an agreement on new multilateral rules in the WTO Doha Round negotiations which would no doubt have impacted on EU-Mercosur talks. However, the main reason for the suspension of EU-Mercosur talks in 2004 is considered to have been a mismatch of the level of ambition for the liberalisation of trade in agriculture.

In 2006, the European Commission published an inception sustainability impact assessment (SIA) and studies for agriculture, the automobile and the forest sectors in 2007. In 2009, a final SIA of the AA’s potential economic, social and environmental implications was published. It did not take into account the latest trade flows and changes in Mercosur countries’ GSP status and did not provide a human rights analysis. In 2010, the Commission issued a position paper on the SIA report.

In 2010, after a long hiatus, talks were re-launched with a significantly enlarged EU against the backdrop of a stalled Doha Round and gridlocked FTAA talks. However, negotiations came to a standstill again in 2012 when Paraguay was suspended from Mercosur, Venezuela joined the bloc and center-left governments in Argentina and Brazil were pursuing other priorities under a south-south cooperation agenda supported by the huge gains from the commodities boom cycle.

In 2016, the EU published a study on the cumulative effect of recent FTAs on the EU’s agricultural sector. It modelled tariff cuts for beef of 25 % and 50 % without a volume limit and identified the EU’s most sensitive and promising agricultural sectors. It shaped the Commission’s negotiating position of offering preferences to Mercosur up to a limited volume through well-calibrated TRQs.

The shift to centre-right pro-business governments in Argentina in 2015 and in Brazil in 2016 opened new prospects for the deadlocked talks. After an exchange of new market access offers in 2016, negotiations gained traction, with the EU implementing its value-based trade agenda of the 2015 Trade for All trade strategy. Agriculture remained the biggest bone of contention, with some EU Member States repeatedly drawing attention to their defensive interests in agriculture.

By late 2018, little progress had been achieved with regard to major EU offensive interests: market access for cars and car parts, dairy products, maritime services, and protection of GIs. However, serious challenges posed to the multilateral trading system by rising unilateralism and protectionism under the America First strategy pursued by the US Administration since 2017, the uncertainties of the impact of the US-China trade war on global trade, the looming departure of the UK from the EU, as well as election dynamics both in the EU and in Mercosur countries in 2019, opened a window of opportunity which the parties seized on 28 June 2019 to strike a deal. If ratified, the EU-Mercosur FTA would create the largest free trade zone in terms of population covered. It would allow European companies to make four times higher savings in terms of tariff cuts than under the FTA with Japan, creating a market that represents nearly a quarter of the world’s GDP. Since the 2009 SIA is outdated, a new one is being conducted, with the inception report of January 2018 providing insights into new developments in EU-Mercosur trade relations. The final report is expected in autumn 2019. To increase transparency during the negotiating process, the European Commission published reports on the negotiating rounds and several text proposals. It also held a series of (sometimes webstreamed) meetings with civil society.

Be the first to write a comment.