The collapse of the Lehman Brothers bank in 2008 started a chain reaction characterised by panic on the markets and a lack of trust, which halted lending. This breakdown of the American financial sector sent the country and then the global economy into the worst recession for more than six decades. The interconnectivity of the global financial system played a key role. For example, European banks, which were heavily involved in subprime mortgage securitisation in the United States, took losses almost as heavily as American banks and played a fundamental role in transmitting the crisis to the EU. Banks from both sides of the Atlantic were using similar business models, and experienced the same problematic financial conditions characterised by severe undercapitalisation and insufficient liquidity.

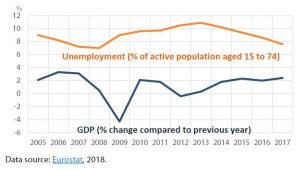

Technically, the recession began in the EU in the second quarter of 2008 – the economy contracted for five consecutive quarters and growth returned only in the second half of 2009 (see Figure 1). Interbank lending dried up and banks were deleveraging and closing credit lines, which halted lending to the economy and caused a negative snowball effect. This stiffening of lending standards was accompanied by a decline in household wealth (due for instance to drops in prices of assets such as stocks and real estate). This meant that investment and demand in the economy plummeted and savings became the preferred option to weather the unfavourable macroeconomic conditions. Manufacturers faced involuntary stock-building, which led to cuts in production. To make matters worse, global trade collapsed in the final quarter of 2008 as business investment and demand for consumer durables plunged.

The poor state of the economy translated rapidly into rising unemployment (Figure 1). A number of countries also witnessed a rise in part-time work and a reduction in hours worked. Overall, male, younger and lower skilled workers were hit particularly hard. While the crisis impacted the whole of the EU, its depth was highly unequal across individual Member States and the recovery took different paths.

Be the first to write a comment.