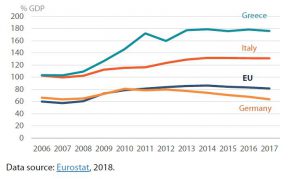

In hindsight, the EU took extraordinary measures to prevent a repetition of an even greater crisis than that of the 1930s. Three main kinds of action were deployed: at EU level, central bank level and government level. In 2008 a large stimulus package called the European economic recovery plan (EERP) was launched by the EU. The ECB took measures to support banking sector liquidity and accommodate the funding needs of banks. The governments also supported the financial system by increasing deposit insurance ceilings, providing guarantees for bank liabilities, and recapitalising banks being bailed out or wound down. In addition, they implemented fiscal measures to reduce the fall-out of crisis on the rest of the economy. This resulted in a mix of ‘automatic stabilisers’ (decreasing tax receipts coupled with increased government welfare payments as the economy slows down) and targeted discretionary fiscal measures, such as additional public investment, tax relief and subsidies for part-time employment. These actions led to a dramatic escalation of public debt (Figure 2).

Government debt 2006-2017

Categories:

Related Articles

Visit the European Parliament page on

Visit the European Parliament page on

We write about

RSS Link to Scientific Foresight (STOA)

RSS Link to Members’ Research Service

Blogroll

Disclaimer and Copyright statement

The content of all documents (and articles) contained in this blog is the sole responsibility of the author and any opinions expressed therein do not necessarily represent the official position of the European Parliament. It is addressed to the Members and staff of the EP for their parliamentary work. Reproduction and translation for non-commercial purposes are authorised, provided the source is acknowledged and the European Parliament is given prior notice and sent a copy.

For a comprehensive description of our cookie and data protection policies, please visit Terms and Conditions page.

Copyright © European Union, 2014-2019. All rights reserved.

Be the first to write a comment.