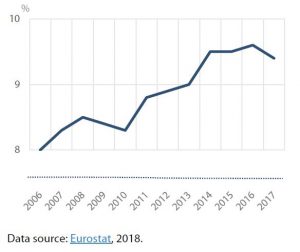

Investment plummeted by around 20 %, with the worst hit countries reporting losses of more than 40 %. A double-dip recession ensued. About 6.7 million jobs were lost between 2008 and 2013. The rise in precarious employment and cuts to benefits contributed to the rising number of ‘working poor’, a figure that has been on the rise since 2010 and now includes one in ten employees (Figure 3). With the exception of Ireland, the countries hardest hit by the crisis have higher than average percentages.

Crucially, a doom loop or vicious circle was exposed, in which sovereign and bank risks fed each other – issues in the banking sector caused fiscal distress while, similarly, decreases in the bond prices of stressed sovereigns worsened the situation in banks that were large holders of sovereign debt. The EU was forced to engage in short-term ‘fire-fighting’ measures such as bailouts to save the banking sector and help stressed sovereigns while at the same time reforming the inadequate existing framework. The ECB expanded its toolbox with unconventional monetary policy measures, providing the banking sector with long-term liquidity, purchasing government bonds and other securities on secondary markets in order to support the sovereigns, and lowering interest rates to avoid deflation (this stimulated demand).

Be the first to write a comment.