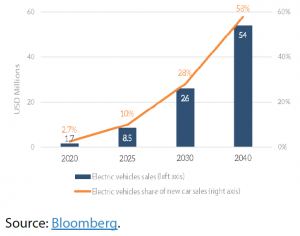

Currently, around 80 % of global battery production capacity is in Asia, with China alone accounting for 69 %, the US for about 15 % and the EU for under 4 %. This situation is unsustainable in the longer term: importing batteries from China significantly increases the carbon footprint of electric vehicles. Moreover, since batteries account for about 40 % of the cost of an electric car, the EU risks jeopardising a large proportion of the value-added part of the production chain and the technological knowledge that can be obtained from it. Developing an EU battery industry offers a solution to this situation and should also help to counter some of the inevitable job losses due to the shift from the traditional combustion engine. Remarkable economic opportunities are possible: the EU market potential could be as high as €250 billion annually from 2025 onwards. Accordingly, EU car manufacturers are progressively widening their range of electric vehicles. The accelerating transition to clean energy means that the demand for batteries is likely to skyrocket. Another inevitable trend is that electric vehicles will have an increasing share in the car market in the coming decades (see Figure 3). Cars based on an electric battery will progressively account for the majority of new cars, with plug-in hybrids phased out as technology based on pure electrics becomes cheaper. However, battery cell manufacturing is an investment-intensive industry at present, necessitating massive volumes and highly automated manufacturing processes.

Global electric vehicles sales and share of all new cars sold

Categories:

Related Articles

Visit the European Parliament page on

Visit the European Parliament page on

We write about

RSS Link to Scientific Foresight (STOA)

RSS Link to Members’ Research Service

Blogroll

Disclaimer and Copyright statement

The content of all documents (and articles) contained in this blog is the sole responsibility of the author and any opinions expressed therein do not necessarily represent the official position of the European Parliament. It is addressed to the Members and staff of the EP for their parliamentary work. Reproduction and translation for non-commercial purposes are authorised, provided the source is acknowledged and the European Parliament is given prior notice and sent a copy.

For a comprehensive description of our cookie and data protection policies, please visit Terms and Conditions page.

Copyright © European Union, 2014-2019. All rights reserved.

Be the first to write a comment.