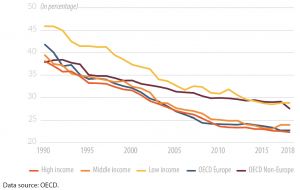

Critically, hyperglobalisation has spilled over into national taxation regimes, which have been characterised by a ‘competition for capital’ at the global level. This has led to a reduction in the tax bases that, in turn, decreases the financial space for nation states to deal with the challenges posed by globalisation. Corporate income tax rates decreased by almost 50 % since 1990, because of competition between countries to retain domestic, and attract foreign, firms and investment in a context of increasing capital mobility

Average corporate income tax rates by country income group

Categories:

Related Articles

Visit the European Parliament page on

Visit the European Parliament page on

We write about

RSS Link to Scientific Foresight (STOA)

RSS Link to Members’ Research Service

Blogroll

Disclaimer and Copyright statement

The content of all documents (and articles) contained in this blog is the sole responsibility of the author and any opinions expressed therein do not necessarily represent the official position of the European Parliament. It is addressed to the Members and staff of the EP for their parliamentary work. Reproduction and translation for non-commercial purposes are authorised, provided the source is acknowledged and the European Parliament is given prior notice and sent a copy.

For a comprehensive description of our cookie and data protection policies, please visit Terms and Conditions page.

Copyright © European Union, 2014-2019. All rights reserved.

Be the first to write a comment.