Used under licence from Shutterstock.com

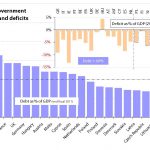

Government debt has reached unsustainable levels in a number of Member States (MS). This is because economic recession since 2008 has led to increased government budget deficits through rising spending (e.g. unemployment benefits) whilst tax revenues have decreased. Also private debt has been transferred to governments through forced nationalisations of, for example, under-capitalised banks. These deficits have added to public debt, which has been increasing since the 1970s.

Two of the five possible solutions for returning to a sustainable level of debt for an economy (60% of GDP is considered a good ratio) are austerity and growth. Austerity reduces state expenditure and increases taxes. However, this takes money out of the economy and tends to reduce its size, possibly leading to a cycle of more cuts and taxes. Growth measures on the other hand, stimulate the economy through government spending (e.g. on infrastructure projects) or lower taxes. This however has an upfront cost, which may not give a sufficient or rapid payback to the cost incurred.

Austerity is painful, as average household income decreases. Growth is positive but over-indebted MS, which are still adding to their debt via annual deficits, have little or no spare spending power. Also, the return tends to be medium to longer term, whereas immediate financial improvements are needed. Each indebted MS is different and will apply different austerity measures, but these should harm growth potential as little as possible.

Click here to read the whole briefing

[…] policy-orientated posts, we started the week with a (un)popular dilemma. Austerity or growth in the EU?, we asked ourselves just a few days before the anti-austerity protests took over Spanish […]