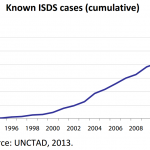

Investor-State Dispute Settlement mechanisms are found in more than 3 000 international investment treaties, but have been increasingly criticised in recent years. Their advocates defend them as a depoliticised neutral system to resolve disputes between foreign investors and host states.

The progress made on comprehensive free trade agreements (FTAs) between the EU and Canada and the United States – in both cases including provisions for ISDS – has intensified discussion on the mechanism in the EU. Some critics have no hesitation in calling it a “toxic mechanism”, which empowers corporations to the detriment of sovereign states’ courts and parliament. Others focus more on an elite arbitration industry that promotes ISDS, in particular through its control of the editorial boards of international law journals covering the field.

The EU supports ISDS arbitration in general, while recognising the need for its reform. Indeed a consensus seems to be emerging on systemic problems faced by this increasingly used system. That has led the European Commission to propose some innovative provisions in the framework of negotiations on EU trade and investment agreements, but without calling into question the ISDS system itself.

Investor-state dispute settlements guarantee investors the right to file a lawsuit against a foreign government whenever their future profits should be at risk. What may sound harmless and justified is in deed an unjust regime which already accounts for many human rights violations, mainly in developing countries. ISDS as they are currently state of the art have already heavily compromised the democratic legislation of many affected states. Read more at http://www.elstel.org/ISDS.html.en