Written by Laura Puccio

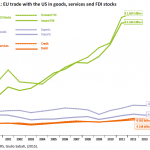

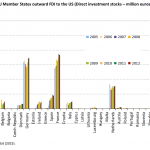

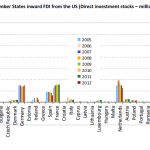

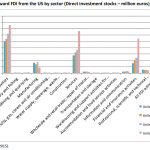

EU FDI stocks in the US amount to €1 651.6 billion and US FDI stocks in the EU to €1 685.5 billion. Investment access and protection are therefore critical to EU-US economic relations. However, the need for an investment chapter in the proposed Transatlantic Trade and Investment Partnership (TTIP), and an Investor-State Dispute Settlement instrument (ISDS), has been questioned repeatedly in the context of these two advanced economies. Concerns focus particularly on differing levels of legal protection for foreign firms, and on the potential impact of investment protection rules on the regulatory capacity of states. The main criticisms of substantive investment protection rules focus on both the vagueness of the legal provision – perceived to lead to expansive and inconsistent interpretations of protection standards – and the capacity of ‘letterbox’ companies to access protection under BITs. The public consultation launched by the Commission on investment protection in TTIP, currently under negotiation between the EU and the US, called for further reform of substantive investment protection clauses. Since the conclusion of the North American Free Trade Agreement (NAFTA), foreign investment provisions have also been criticised in the US. As a result, the US has revised its drafting of investment protection rules.

This analysis shows that investment-protection rules have been used as a safeguard against future changes in domestic protection levels. The US has investment-protection provisions in accords with 21 EU Member States; these may be very different, depending on the type of agreement used, and the time period in which the agreements were concluded. Among the agreements between the US and EU Member States, the most advanced investment-protection rules, including investor-state dispute settlement, are included in the BITs concluded between the US and nine Member States. In the recent agreement between the US and Australia, where no ISDS mechanism is foreseen, the investment chapter is still included as a guarantee in case the domestic situation should change.

Finally, both the US and the EU have taken measures to clarify the interpretation of the rules and avoid expansive application of protection standards, as well as to avoid frivolous claims or ‘forum shopping’. These approaches are often fairly similar, and can even be complementary. Development of the rules tends towards a more balanced approach, allowing both protection of investment and legitimate regulatory changes. The main difficulty in this exercise is to make sure that additional clarity does not constrain states’ actions, nor that the law loses the flexibility needed to cover all eventualities. A tentative EU answer to some of these issues has already been given by the Commission in its draft proposal for the TTIP investment chapter, published on 16 September. However, the draft EU proposal is still incomplete as several provisions have not yet been inserted and remain under discussion.

Both the EU and the US have, in the past, tackled the issue of ‘forum shopping’ by ‘letterbox’ companies established on their territories in their treaties. However, both the US and the EU investment protection rules are very different from the BIT models used in some EU Member States (such as the Dutch model) where foreign investment protection is both easily accessible and broad in scope. The problem of ‘forum shopping’ might therefore persist due to the continued application of intra-EU BIT, and the differences in investment protection standards applied in the intra-EU BITs and the investment chapters currently negotiated by the European Commission in EU FTAs.

[…] Click to view slideshow.Filed under: International Relations, PUBLICATIONS Tagged: In-depth analysis, investment, investment policy, Laura Puccio, trade agreements, TTIP […]

I am still surprised how little attention is spent on the basic emperical data analysis and just built and anecdotical and little disguised politically influenced stories. If the EU were to stick to test and prooven BITs such as the German model BIT, few things would need to be discussed, that is of cause as long you stay within a minimum rule of law. If you want to role back and see the untamed Levithian as the ultimate goal for the EU to evolve to, then of cause you should be scared of investment protection …

To name a few deficiancies here: US-AUS BIT is everything but new and the US is probably regretting as it still kept ISDS in its 2012 model BIT after intense revision (under Democratic leadership someone may add).

The so-called forum shopping – if it ever existed – will apply the same way to any BIT, not only to intra-EU (the Intra-EU question has a totally different background). Test the EU institutions on its intentions by asking a simple question: the easiest way to stop possible forum shopping is to clearly and significantly narrow the scope to bricks and motar investments (no portfolio crap etc.) … but I guess this will not fit strategy …

Finally, to call the link between BITs and investment inconclusive runs counter to more than five decades of state investment guarantees – something the EU Commission is after to gain competence in for more than 40 years … (mind a second who ‘invented’ BITs and why).

In short: too much politics in this paper, too little sound research.

Dear Chris,

In the view of your comments, it would be important to clarify the following points.

– The AUSFTA example is not given as an example of why there should or there should not be ISDS. The paper is not on the issue of ISDS, it is only about some of the substantial investment protection rules. The AUSFTA example, here, is used to show that these rules are present in US agreements with or without an ISDS framework.

– there is in the paper a sufficiently long discussion on the historical developments of investment protection rules (which by the way starts before the creation of BITs) pointing out why those are important and how investment rules contributed to the protection of individual rights in international public law (including ISDS features as it provided individuals with direct claims under international public law)

– the paper does not say that BITs do not have economic impact. It says that some studies found positive effects and other had inconclusive findings. After clarifying why some papers found positive results, the paper argues that where economic results have been inconclusive with respect to the positive effect of BITs, the latter could be attributed to preference erosion, as the proliferation of BITs creates an equal playing field from the point of view of investment protection. In other words, the different countries having concluded a BIT with the same country will compete on an equal basis from the investment protection point of view, these countries will then have to compete for FDIs on the basis of other comparative advantages. So what the study wants to suggest is that it might be easier to find a stronger negative impact on FDIs flows to a country caused by the absence of an investment agreement, much more than to find a substantial positive effect created by the existence of an investment agreement.

– With respect to forum-shopping, the paper only points out that there will be legal discrepancy between the revised EU investment rules and some of the unchanged intra-EU BITs rules, and this could lead to circumvention via intra-EU BIT of the newly EU negotiated rules. So that at a certain point the relations between EU investment rules and intra-EU BIT will have to be taken into account.

[…] such as the continued protection and promotion for Europe’s artists and unique culture and Investor State Dispute Settlement. The extent of public interest in the proposals demonstrates that Europeans are both interested and […]