Written by Angelos Delivorias

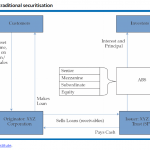

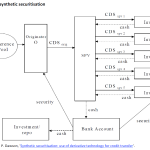

Securitisation is a financing technique by which homogeneous income-generating assets − which on their own may be difficult to trade − are pooled and sold to a specially created third party, which uses them as collateral to issue securities and sell them in financial markets. This presents advantages to issuers (e.g. it allows them to reduce funding costs and increase their funding capacity while still satisfying regulatory capital requirements), investors and markets, and it may even have broader economic and social benefits. At the same time, securitisation can be a source of risk to the financial system. A case in point is how it amplified the recent financial crisis by contributing to lengthening the intermediation chain, by creating conditions which resulted in misaligned incentives and interests between participants in the securitisation chain, by increasing the reliance on mathematical models and on external risk assessments and, finally, by increasing both individual and systemic bank risks.

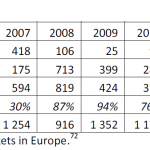

Nevertheless, although the European securitisation market grew significantly in the run up to the crisis, it has dramatically contracted since, despite the fact that most European securitised products fared well in the recent financial crisis in comparison with their US counterparts.

In the current low-growth and cautious lending environment, a simple form of securitisation was advocated by many, to equip banks with the necessary funds to provide new lending to the real economy. Thus, in the context of the creation of the Capital Markets Union, various stakeholders have published their reflections and launched consultations on what possible changes could be brought to the process of securitisation itself, in order to simplify it, render it less opaque and, as a result, reduce its potential risk.

Read this In-depth Analysis on Understanding Securitisation: Background − benefits − risks in PDF.

Be the first to write a comment.