Written by Cécile Remeur (2nd edition),

Hybrid mismatch is a situation where a cross-border activity is treated differently for tax purposes by the countries involved, resulting in favourable tax treatment. Hybrid mismatches are used as aggressive tax planning structures, which in turn trigger policy reactions to neutralise their tax effects.

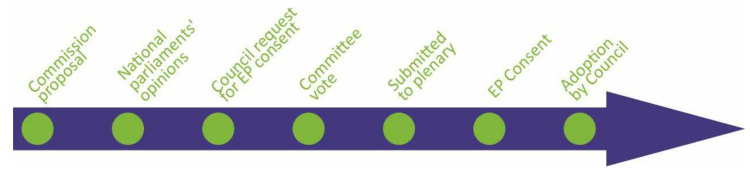

When adopting the Anti-Tax Avoidance Directive in July 2016, the Council requested that the Commission put forward a proposal on hybrid mismatches involving third countries. The amendment proposed by the Commission on 25 October broadens the provisions of the directive accordingly. It seeks to neutralise mismatches by obliging Member States to deny the deduction of payments by taxpayers or by requiring taxpayers to include a payment or a profit in their taxable income. The Parliament’s opinion was prepared by the Economic and Monetary Affairs Committee.

As this is a tax measure, Parliament is only consulted. The proposal was adopted by the Council on 29 May 2017.

Interactive PDF

| Proposal for a Council Directive amending Directive (EU) 2016/1164 as regards hybrid mismatches with third countries | ||

| Committee responsible: | Economic and Monetary Affairs (ECON) |

COM(2016) 687 2016/0339(CNS) Consultation procedure – Parliament adopts only a non-binding opinion |

| Rapporteur: | Olle Ludvigsson (S&D, Sweden) | |

| Shadow rapporteurs:

|

Sirpa Pietikäinen (EPP, Finland)

Pirkko Ruohonen-Lerner (ECR, Finland) Nils Torvalds (ALDE, Finland) Matt Carthy (GUE/NGL, Ireland) Eva Joly (Greens/EFA, France) |

|

| Procedure completed. | Council Directive (EU) 2017/952 of 29 May 2017 OJ L 144, 7.6.2017, p. 1. |

|

![Hybrid mismatches with third countries [EU Legislation in Progress]](https://theme-one.epthinktank.be/app/uploads/2017/03/eprs-briefing-599354-hybrid-mismatches-third-countries-final.jpg)

[…] Source Article from https://epthinktank.eu/2017/03/22/hybrid-mismatches-with-third-countries-eu-legislation-in-progress/ […]