Written by Alessandro D’Alfonso, Angelos Delivorias, Magdalena Sapała, Marcin Szczepanski, Ioannis Zachariadis.

Graphics by Giulio Sabbati.

In 2018, the EU and euro-area economies continued their moderate growth (2.1 %). This growth was based on domestic private and public consumption and on strong investment – itself stemming from low interest rates and high business confidence, which is, however, likely to deteriorate slightly going forward. It was also underpinned by the creation of jobs: unemployment is currently at a post‑crisis low and labour market conditions are expected to continue improving over the next two years, albeit more moderately than previously.

The global outlook in which this growth is taking place, however, is less promising than it was a year ago. Indeed, for the first time in almost 30 years, the expansion of trade liberalisation came to a halt in 2018. World merchandise trade volumes grew less in 2018 than in the previous year, and are expected to decrease further in the near future, especially in the event of an escalation in current trade tensions. Partly as a result of the above, EU exports were subdued and are projected to remain so in the near future. In addition to the above, specific risks revolving around private and public finances, financial markets, monetary policies and trade, as well as the gloomier forecast for key emerging economies, such as Argentina, Brazil, Iran, Turkey, Venezuela or South Africa are signs that global expansion has peaked (3.7 %) in 2018, and should begin to decelerate in 2019 and 2020 (3.5 %). In this context, the EU and euro area is expected to continue growing, but at an even lower pace over the next two years (between 1.8 % and 1.9 %).

In this context, while the European Central Bank reduced its purchases under the purchase programmes significantly in 2018, and decided to end them by December, it decided to continue reinvesting the principal payments from maturing securities purchased under those programmes and to keep using its forward guidance. The aforementioned trends, the different pace of monetary policy normalisation in the United States and the United Kingdom on one hand and in the euro area on the other, trade tensions in world markets, but also specific fiscal issues relating to particular Member States, resulted in a mixed picture compared with last year, with the euro appreciating slightly versus emerging market currencies, while at the same time weakening versus the dollar, the yen and the pound sterling.

Following the now established pattern, the study delves into two of the tools and initiatives that European institutions use to contribute to the European response to the aforementioned developments: the European Union budget and the way it is designed to tackle challenges, and EU initiatives aimed at supporting small and medium-sized enterprises (SMEs).

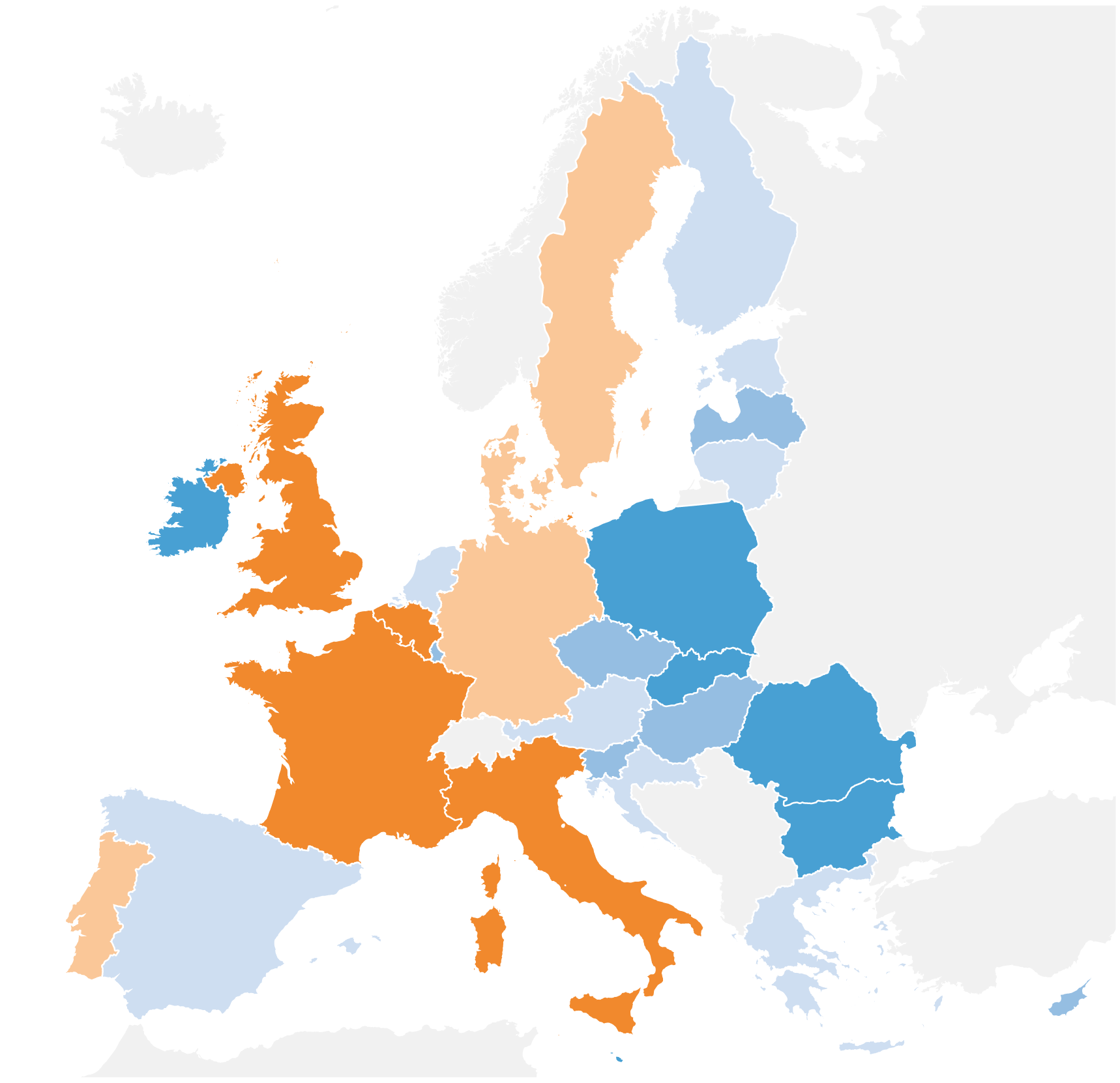

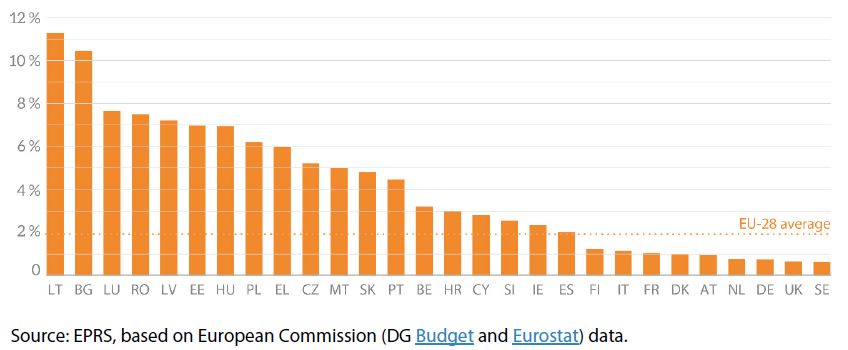

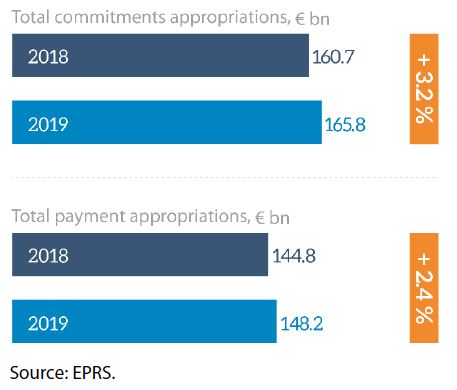

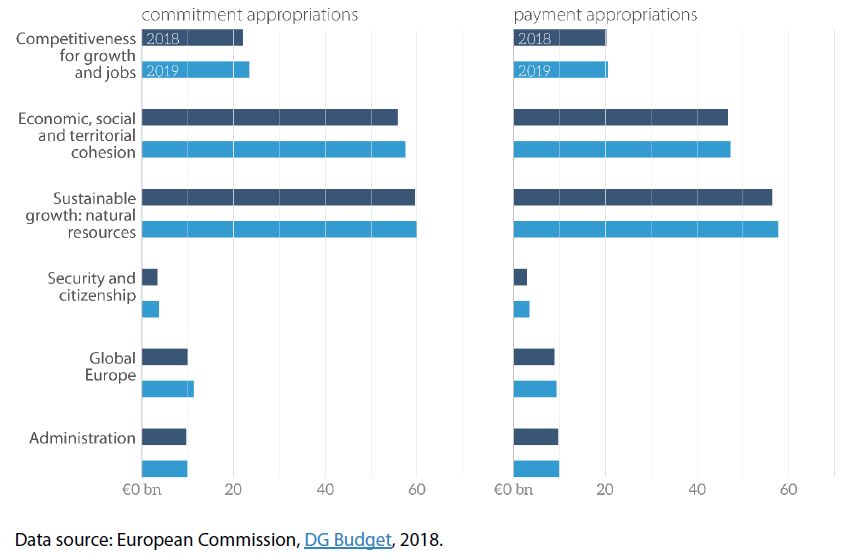

The 2019 EU budget amounts to €165.8 billion, representing only 2 % of total public spending in the European Union – approximately 1 % of gross national income (GNI). Despite its volume, the overall impact of the EU budget is amplified by a number of features, including: a higher share of resources devoted to investment than in national budgets; the capacity to leverage additional funding from other sources; and attention to policy areas where the pooling of resources can provide the EU as a whole with added value (e.g. research, innovation and development cooperation).

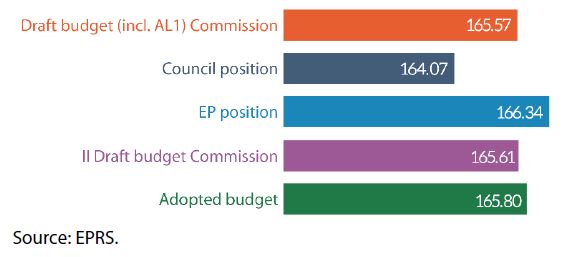

Agreed by the European Parliament and the Council of the European Union, the 2019 budget focuses on priorities such as stimulating investment, growth and research, creating new jobs, especially for young people, as well as addressing migration and security challenges. In 2019, for the fifth year in a row, the budgetary authority had to have recourse to the flexibility provisions available under the EU’s 2014-2020 multiannual financial framework (MFF) in order to finance these persistent policy challenges.

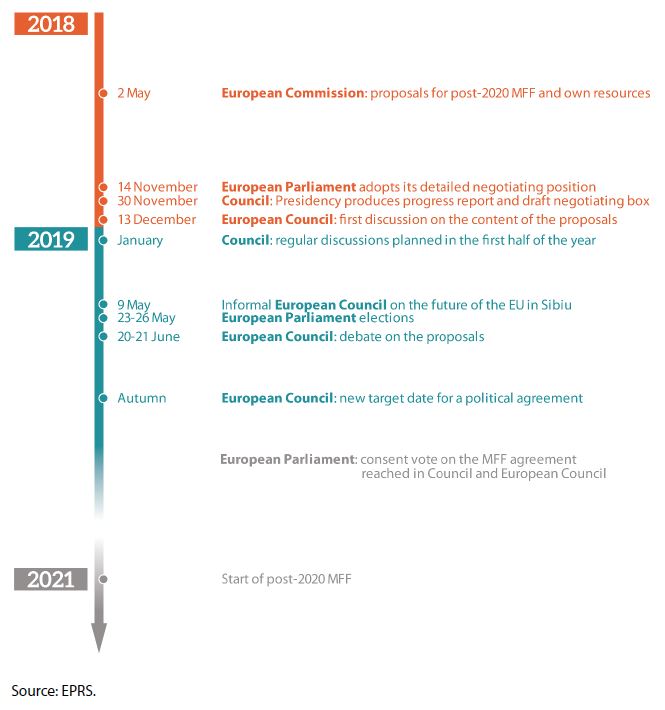

In 2019, the shaping of the next MFF, which should cover the 2021 to 2027 period, is expected to gain momentum. EU institutions and Member States are working on the proposals put forward by the Commission in 2018, which include a number of modifications to the way the EU budget is currently financed and spent. Taking into account the expected withdrawal of the UK from the EU, the proposed allocations for 27 Member States are organised around a new structure reinforcing priorities that emerged during the current MFF, such as research, innovation, digital transformation, climate action, borders, migration, security and defence. The objective is to reach an agreement in autumn 2019, but the start of a new political cycle for several key EU institutions might pose a challenge for this.

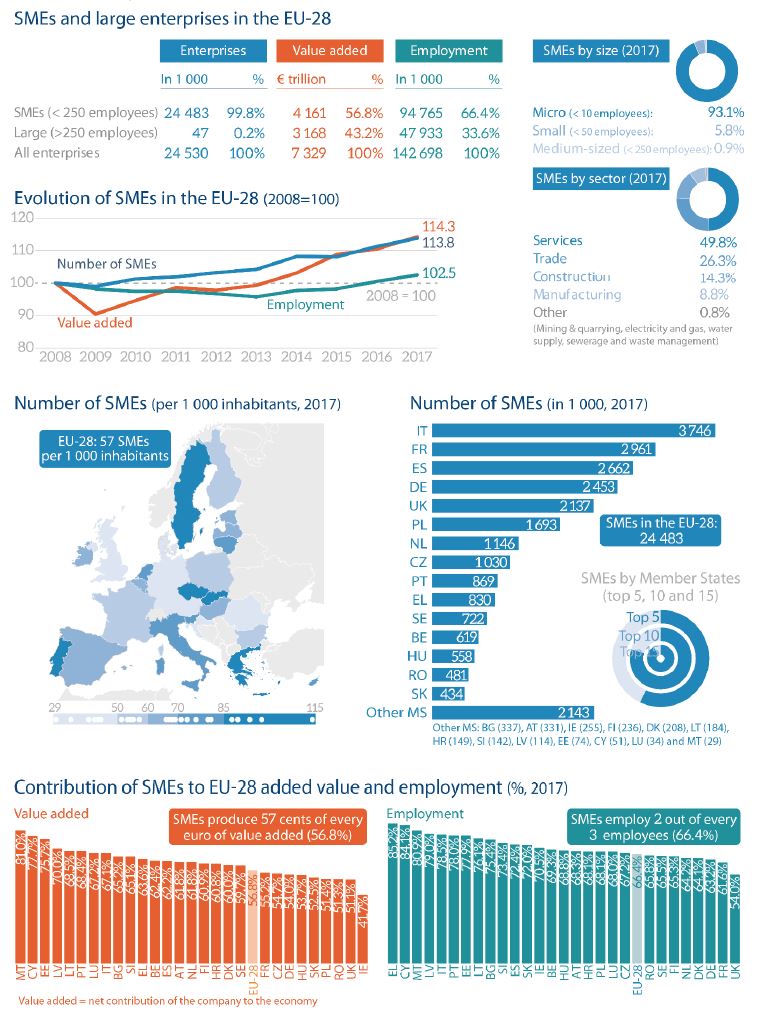

The EU budget devotes particular attention to SMEs, supporting them across a wide range of programmes and instruments. SMEs are crucial to European economy since they constitute 99.8 % of all non-financial enterprises in Europe. In 2017, these firms employed close to 95 million people which means that two out of three workers in the EU had a job in this sector. Furthermore, European SMEs generated around €4.16 trillion, amounting to 57 % of total added value. European SMEs were badly affected by the economic and financial crisis starting in 2008 and only since 2014 have employment and value added been increasing. The recovery is also manifested in the fact that between 2008 and 2017, gross value added generated by SMEs increased cumulatively by 14.3 % and employment in these companies increased by 2.5 %. Value added and employment are also expected to grow in 2019.

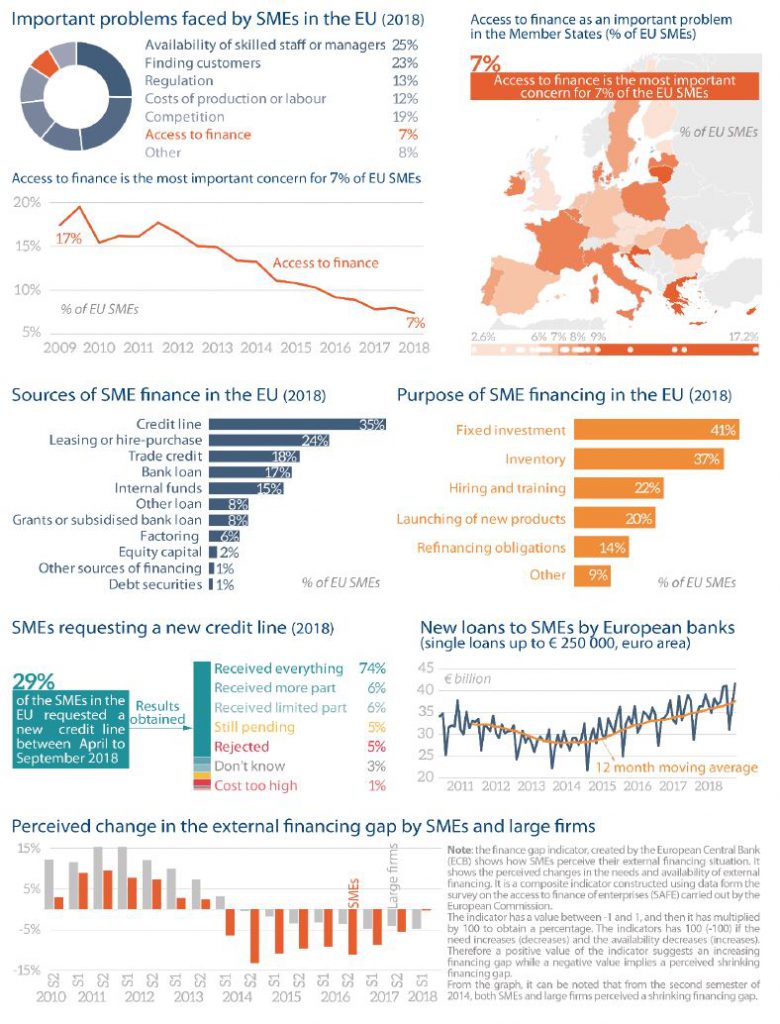

Sustaining the continued growth of European SMEs relies, not least, on ensuring sufficient access to external finance – an area where they are typically considered to be at a disadvantage relative to larger firms. However, recent evidence indicates that the environment for their access to financing is gradually improving across the EU. In 2018, only 7 % of SMEs reported ‘access to finance’, as their most serious concern. This is a notable improvement when compared with the 17 % reported in 2009. Notwithstanding this positive development, traditional debt finance – whether in the form of credit lines, overdrafts, trade credit or standard bank loans – continues to be the primary source of external funding for the majority of SMEs, with alternative financing instruments remaining among the least preferred options. The heavy reliance on debt finance that has traditionally characterised European SMEs contributed heavily to their increased vulnerability during the recent economic downturn. In view of the persistent challenges, public attention is increasingly drawn to the potential of capital markets to offer alternative sources of financing for SMEs. As such, diversification of sources of funding through the development of deeper and more integrated capital markets is gaining increasing traction. Providing companies, especially smaller ones, with a broader choice of market-based funding at a lower cost, can help stimulate investment, thereby promoting sustainable economic growth and job creation.

Read the complete study on ‘Economic and Budgetary Outlook for the European Union 2019‘ in the Think Tank pages of the European Parliament.

[…] Source Article from https://epthinktank.eu/2019/01/31/economic-and-budgetary-outlook-for-the-european-union-2019/ […]