Written by Angelos Delivorias (1st edition),

The pricing of many financial instruments and contracts depends on the accuracy and integrity of (financial) benchmarks, i.e. indices, by reference to which the amounts payable under such financial instruments or contracts, or the value of certain financial instruments, are determined. The anticipated discontinuation of such a benchmark (LIBOR) after the end of 2021 has created fears that it could lead to disruption in the internal market, given that the Benchmarks Regulation ((EU) 2016/1011) does not provide for mechanisms to organise the orderly discontinuation of systemically important benchmarks in the EU. That is why the Commission has proposed to amend the said regulation. The Council adopted its negotiating mandate on 6 October, while the European Parliament’s Economic and Monetary Affairs Committee (ECON) adopted its report on 19 November 2020, and also voted to open trilogue negotiations with the Council.

Complete version

| Exemption of certain third country foreign exchange benchmarks and the designation of replacement benchmarks for certain benchmarks in cessation | ||

| Committee responsible: | Economic and Monetary Affairs (ECON) | COM(2020) 337 24.7.2020 |

| Rapporteurs: | Caroline Nagtegaal (Renew, The Netherlands) | 2020/0154(COD) |

| Shadow rapporteurs: | Luděk Niedermayer (EPP, Czechia) Jonás Fernández (S&D, Spain) Jörg Meuthen (ID, Germany) Ville Niinistö (Greens/EFA, Finland) Patryk Jaki (ECR, Poland) José Gusmão (GUE/NGL, Portugal) |

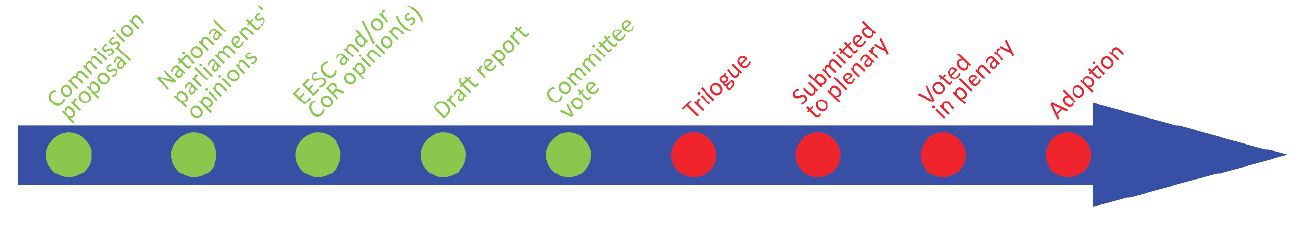

Ordinary legislative procedure (COD) (Parliament and Council on equal footing – formerly ‘co-decision’) |

| Next steps expected: | Trilogue negotiations | |

![Replacement benchmarks for financial benchmarks in cessation [EU Legislation in Progress]](https://theme-one.epthinktank.be/app/uploads/2020/11/eprs-briefing-659373-replacement-financial-benchmarks-final.jpeg.png)

[…] Source Article from https://epthinktank.eu/2020/11/30/replacement-benchmarks-for-financial-benchmarks-in-cessation-eu-le… […]