The ‘shale revolution’

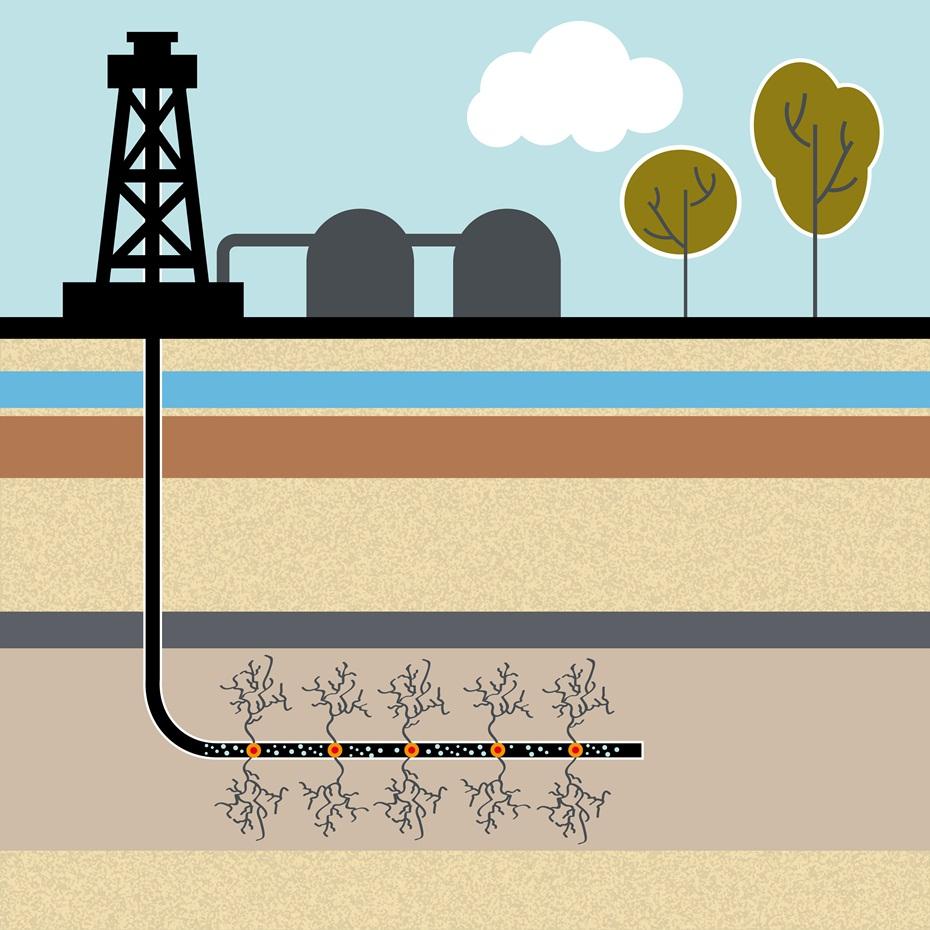

Over the past decade, the United States and Canada have experienced spectacular growth in the production of unconventional fossil fuels, notably shale gas and tight oil, thanks to technological innovations such as horizontal drilling and hydraulic fracturing (fracking).

Economic impacts

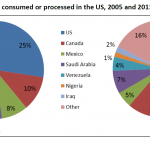

This new supply of energy has led to falling gas prices and a reduction of energy imports. Low gas prices have benefitted households and industry, especially steel production, fertilisers, plastics and basic petrochemicals.

The production of tight oil is costly, so that a high oil price is required to make it economically viable. For this reason, analysts do not expect that the additional production capacity will lead to lower prices. However, it may well prevent oil prices from rising even higher.

Environmental and social concerns

Environmental concerns about fracking persist, and are being addressed by industry and regulators. The replacement of coal by gas for electricity production has led to a drop in US greenhouse gas emissions. The future climate impact of shale gas would be positive if it replaces dirty coal, and methane emissions can be minimised. On the other hand, it would be negative if cheap gas discourages investments in energy efficiency and renewable energy sources.

Global energy flows

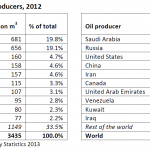

The shale revolution in North America has changed global energy flows. North America imports less energy, so that more liquefied natural gas (LNG) is available for Asian markets. US coal is exported to Europe and Asia, as it has been replaced by gas for electricity generation in the US. To enable gas exports from the US, it is planned to convert LNG import terminals (which had been built in the expectation of rising gas imports) to export terminals.

Upcoming free-trade agreements will make it easier for US companies to export gas and to invest in shale gas and tight oil production overseas. US foreign policy encourages the development of unconventional energy sources abroad.

Outlook

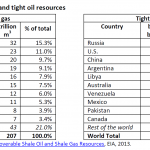

The shale boom in the US has been enabled by specific geological, geographic, industrial, financial and regulatory factors in North America. The coming years will show to what extent the ‘shale revolution’ can be replicated in other regions and make a contribution to EU energy security.

In the light of considerable uncertainty about the extent of the ultimately recoverable shale gas and tight oil resources, analysts are divided about the longer-term outlook for North American energy production. Some believe that we look forward to a century of abundant energy supplies, and even North American energy independence. They see North America as a future net energy exporter. Others fear that the shale revolution is a short-lived financial bubble, and predict energy scarcity and rising prices. Clearly, how this plays out will have a major impact on energy policies and the engagement of the US in energy-producing regions such as the Middle East.

Read the whole In-Depth Analysis here

[…] North America has managed to reduce its energy imports by exploiting shale gas, tight oil and oil sands. Could the American experience be a model for other regions? Find out about the impacts of these alternative extraction methods on the economy, the climate and the environment in our in-depth analysis unconventional oil and gas in North America. […]