Written by Angelos Delivorias (1st edition),

Preserving the ability of banks to continue lending to companies, especially small and medium-sized enterprises, is key when it comes to softening the economic impact of the pandemic and easing recovery. The Commission believes that securitisation can contribute to this. It also considers that in order to increase the potential of securitisation the EU regulatory framework (Regulations (EU) 2017/2402 and (EU) 575/2013) must be updated, to cater for (i) on-balance-sheet synthetic securitisation and (ii) the securitisation of non-performing exposures (NPEs).

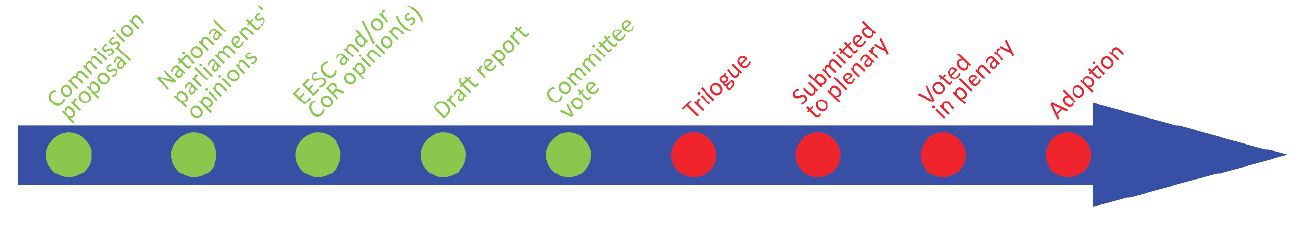

The proposal, which is partly based on two recent documents by the European Banking Authority and on draft standards proposed in July by the Basel Committee on Banking Supervision, has been examined by the co-legislators, and both the European Central Bank and the European Economic and Social Committee have published opinions. Trilogue negotiations are now under way.

Complete version

| (A) General framework for securitisation and specific framework for simple, transparent and standardised securitisation to help the recovery from the COVID-19 pandemic and (B) Capital Requirements Regulation (CRR): adjustments to the securitisation framework to support the economic recovery in response to the COVID-19 pandemic |

||

| Committee responsible: | Economic and Monetary Affairs (ECON) | COM(2020) 282 (A) COM(2020) 283 (B) 24.7.2020 |

| Rapporteurs: | Paul Tang (S&D, the Netherlands) (A) Othmar Karas (EPP, Austria) (B) |

2020/0151(COD) (A) 2020/0156(COD) (B) |

| Shadow rapporteurs: | Othmar Karas (EPP, Austria) (A) Jonás Fernández (S&D, Spain) (B) Luis Garicano (Renew, Spain) (A, B) Marco Zanni (ID, Italy) (A, B) Philippe Lamberts (Greens/EFA, Belgium) (A, B) Johan Van Overtveldt (ECR, Belgium) (A, B) Chris MacManus (GUE/NGL, Ireland) (A, B) |

Ordinary legislative procedure (COD) (Parliament and Council on equal footing – formerly ‘co-decision’) |

| Next steps expected: | Conclusion of trilogue negotiations | |

![Amending securitisation requirements for the impact of coronavirus [EU Legislation in Progress]](https://theme-one.epthinktank.be/app/uploads/2020/12/eprs-briefing-659418-securitisation-requirements-coronavirus-final.jpeg.png)

Be the first to write a comment.